Obama Care/ Covered CA

In 2010, President Barack Obama signed into law a federal statute called the Patient Protection and Affordable Care Act (PPACA). The PPACA, which was later shorted to Affordable Care Act and later nicknamed Obamacare, is a health care reform that ensures all Americans can get health insurance. Most importantly, Obamacare wanted to lower the cost of health care as it had become quite expensive to access medical care.

Under California’s Obamacare, some of the most important changes are highlighted as below:

- Employers or businesses that have more than 50 employees have to provide health insurance for their employees that meet the minimum requirements set by the government or risk paying penalties.

- No insurance company can deny health insurance based on pre-existing conditions.

- There is a state run marketplace, Covered California, where you can compare prices. Based on your income, you can get premium subsidies that might lower your premium health insurance charges.

- Young adults can be added to their parents’ health insurance plan until the age of 26.

Requirements for Obamacare in California

Before enrolling in California’s Obamacare, there are a few things you’ll be required to present:

- Social Security number and legal status proof of documents

- Previous year’s tax record or other proof of income for your family

- Household Size. You will need to list everyone in your household who will be on your federal tax return for the year you will be receiving coverage.

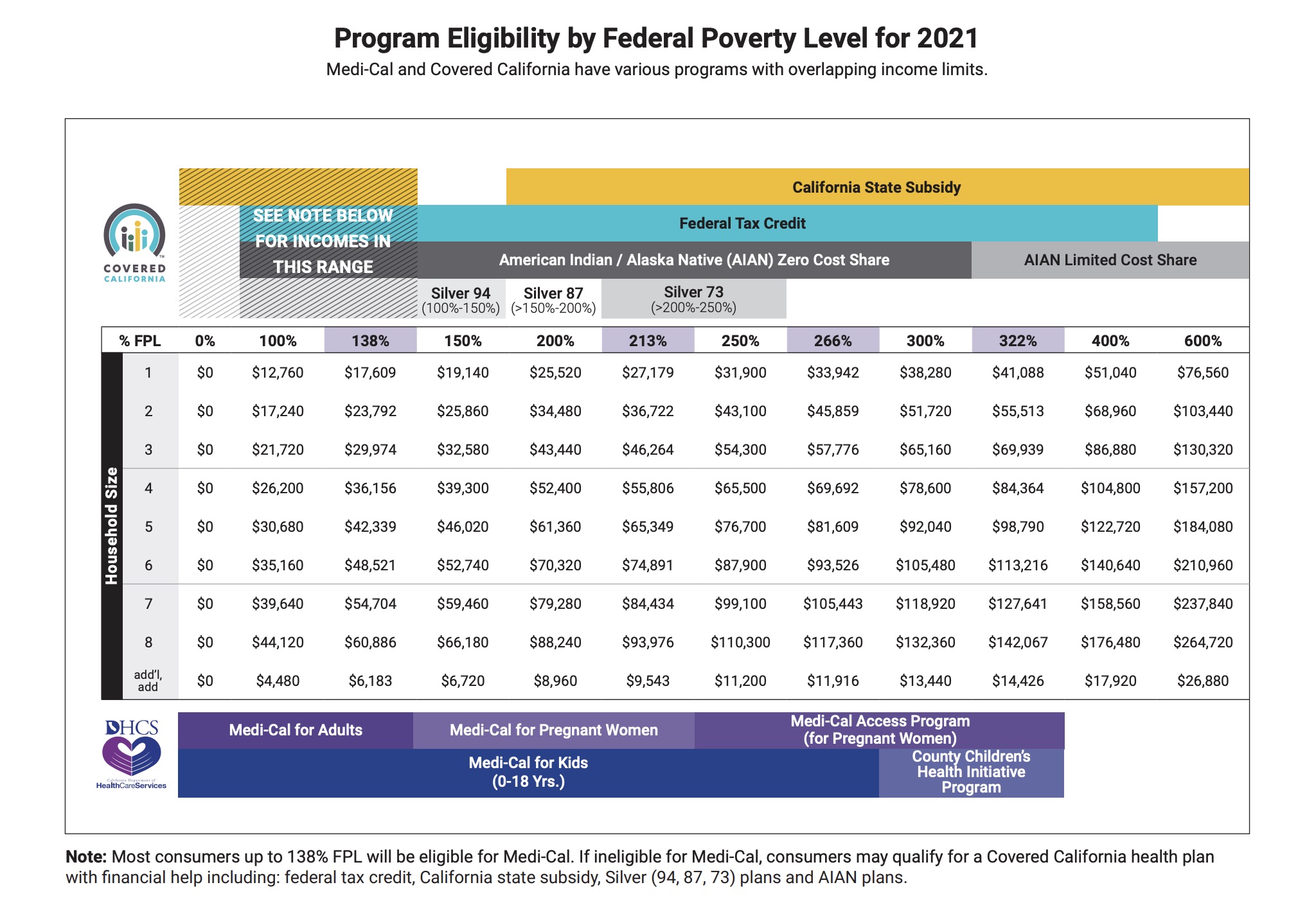

Subsidies or Tax Credits

A subsidy or tax credit refers to financial assistance from the federal government that can be received monthly or as a lump sum. When a tax credit is received monthly it is called an Advanced Premium Tax Credit (APTC) and is paid directly to the insurance carrier to reduce your monthly bill. APTC is available only to individuals who purchase their health insurance through state exchange and in California it’s called Covered CA.

APTC in California is available to households who do not have an offer of affordable employer health insurance and whose income falls between 138% and 400% of the Federal Poverty Level.

For adults, the following Covered California income restrictions apply:

- 0% – 138% of FPL: You qualify for Medi-Cal. No premium assistance!

- > 138% – 400% of FPL: You qualify for a subsidy on a Covered California plan.

- > 138% to 150%: You also qualify for the Silver Enhanced 94 Plan. 🔥

- > 150% to 200%: You also qualify for the Silver Enhanced 87 Plan.

- > 200% to 250%: You qualify for the Silver Enhanced 73 Plan.

Do you want to know exactly how much premium assistance you can receive based on your income? Please click here

At CKS Insurance, we are certified agents for Covered CA and we can help you apply at absolutely no cost! Contact us Now!

中文

中文